MMRCL sets Rs 51.73 billion minimum price for Nariman Point metro

AI-powered laser welding from TRUMPF boosts auto manufacturing quality

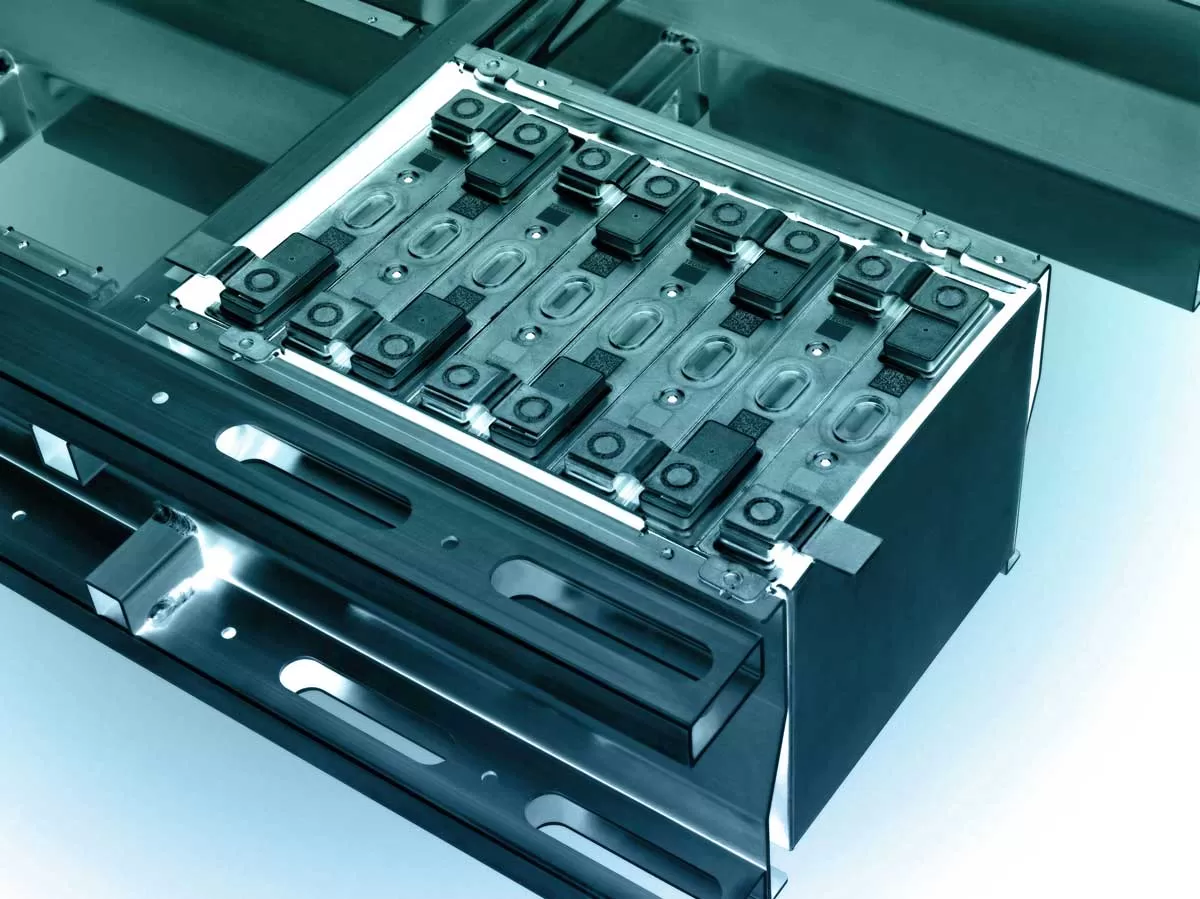

TRUMPF is using artificial intelligence (AI) to increase productivity in automotive manufacturing. The high-tech company has developed an AI solution that checks the quality of components, such as batteries for electric cars, immediately after laser welding, identifies possible defects and enables repairs in the laser welding station. "This enables users to reduce their manufacturing costs because the AI solution can replace other time-consuming quality inspections," says Martin Stambke, the TRUMPF product manager responsible for AI quality inspection. The first customers from the automotive i..

Real estate expects boost as RBI MPC meeting nears with rate cut hopes

The Monetary Policy Committee is scheduled to convene on April 7, 8, and 9, 2025, to assess the current economic landscape and determine the direction of interest rates. Experts and industry stakeholders are closely monitoring the meeting, as any decision regarding a potential change in the repo rate could have significant implications for borrowing costs, market liquidity, and overall economic momentum. The outcome of this review will play a crucial role in shaping financial and investment strategies across various sectors. Pradeep Aggarwal, Founder & Chairman, Signature Global (India) Ltd...

Maxxdrive industrial gear units by Nord Drivesystems

Although relatively new, the MAXXDRIVE® industrial gear units from NORD DRIVESYSTEMS are among the established drive solutions for heavy-duty applications. Apart from conveying, lifting and driving, mixing and agitating are among the most important application areas. For the agitators in a non-standard biogas plant in the Netherlands, the powerful industrial gear units significantly contribute to the implementation of gas production. MAXXDRIVE® industrial gear units from NORD DRIVESYSTEMS can be found in all industrial applications, where high performance and high ratios are required. They..