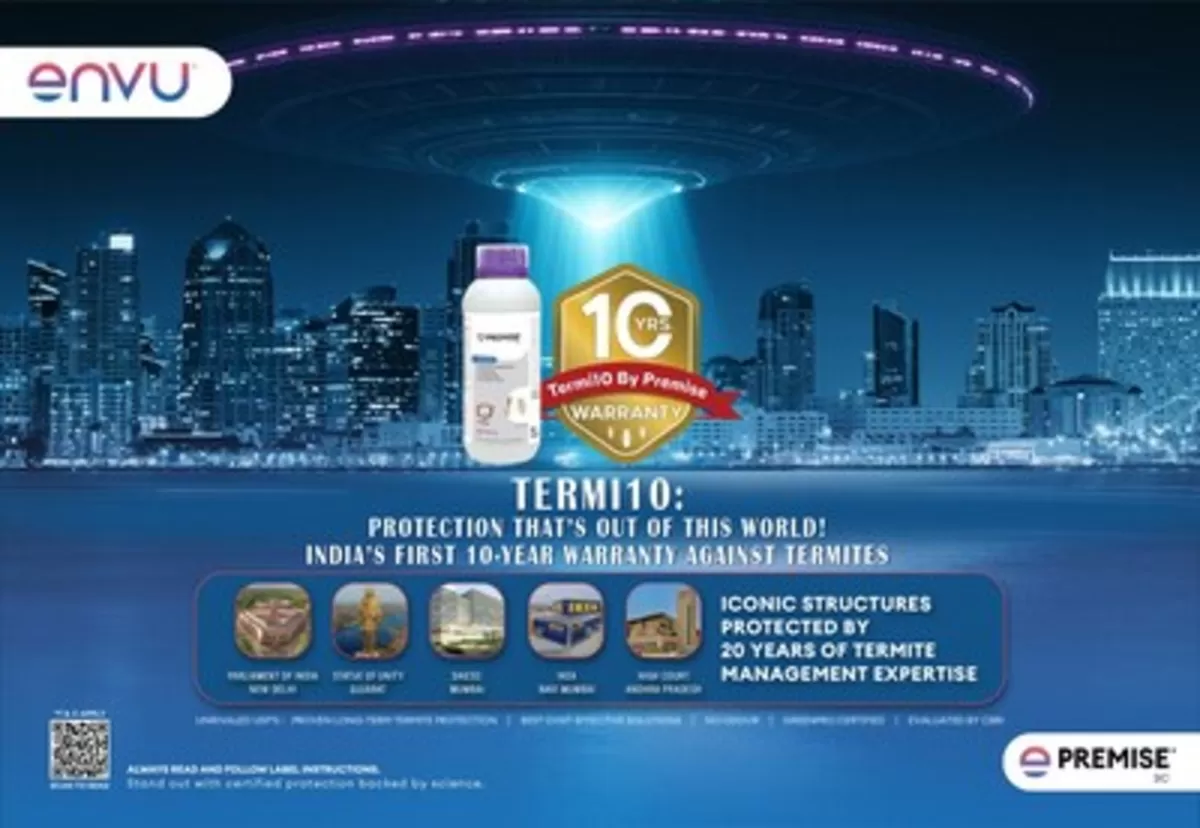

Envu Launches India’s First Certified 10-Year Termite Warranty with Premise

Envu India has introduced a Certified 10-Year Warranty on its flagship anti-termite solution, Premise (Imidacloprid 30.5 per cent SC), marking a category-first for India's structural pest management sector. This warranty is available exclusively to certified members of the Envu Pest Expert Alliance (EPEA), aiming to provide long-term protection from termite damage in pre-construction projects.Premise is the only anti-termite solution in the country endorsed by both the Central Building Research Institute (CBRI) and GreenPro, reinforcing its reputation as a scientifically validated product with..

Rustomjee Unveils 35,000 Sq. Ft. Industry-First Labour Housing for 500 Workers

Rustomjee Group has launched a 35,000 sq. ft. labour housing facility at its Urbania site in Thane, marking a first-of-its-kind initiative in Indian real estate. Inaugurated on April 13, the accommodation can house 500 workers across 84 well-ventilated rooms, each 10 ft by 10 ft, with up to six individuals per room.Rooted in Rustomjee’s ethos of care and community, the facility is designed not just for shelter, but as a holistic, nurturing ecosystem. “At Rustomjee, we believe that the people who build our cities deserve to be at the heart of them. Our newly developed labour accommodation a..

Cyient wins key green hydrogen contract for project in Norway

Cyient, the Indian multinational technology company, has secured a strategic contract to support GreenH Bodø in the development and execution of a pioneering green hydrogen production and distribution facility at Langstranda in Bodø, Norway. This flagship initiative is part of a joint venture between GreenH, a Norwegian green hydrogen infrastructure firm, and Luxcara, a Hamburg-based independent asset manager specialising in renewable energy projects across Europe. The project represents a major step towards fulfilling Norway’s ambitious renewable energy goals, particularly within the ma..