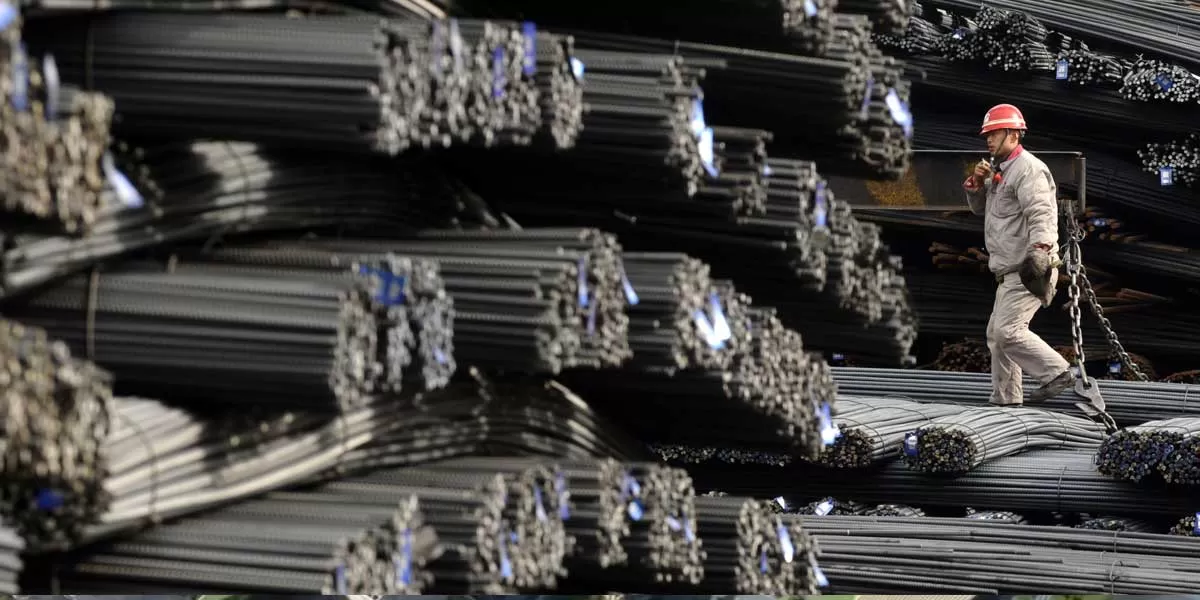

India is witnessing a significant surge in steel imports from China, contributing to a growing trade deficit and challenging the domestic steel industry. This trend is alarming for India's economic stability, as the steel sector is a crucial component of its industrial growth. The influx of cheaper Chinese steel is causing ripples across the Indian market, affecting local producers and raising concerns about the long-term impact on the nation's trade balance.

Surge in Chinese Steel Imports: Chinese steel imports into India have risen sharply, making China the dominant player in the Indian steel import market. This surge is attributed to China's aggressive pricing strategies, which make its steel products more affordable for Indian buyers. As a result, Indian companies are increasingly opting for Chinese steel over domestically produced alternatives.

Growing Trade Deficit: The rise in steel imports from China is exacerbating India's trade deficit, particularly in the steel sector. India's steel exports are declining, while imports are on the rise, leading to a widening gap in the trade balance. This growing deficit poses a challenge for the Indian economy, as it indicates a reliance on foreign goods and a potential strain on foreign exchange reserves.

Impact on Domestic Steel Industry: The influx of cheaper Chinese steel is putting significant pressure on the Indian steel industry. Domestic producers are struggling to compete with the low prices offered by Chinese suppliers, leading to reduced profit margins and, in some cases, production cuts. The Indian steel industry, which has been a cornerstone of the country's industrial development, is now facing a potential crisis due to this foreign competition.

Economic and Strategic Concerns: The dominance of Chinese steel in the Indian market raises both economic and strategic concerns. Economically, the dependence on imports undermines the growth of India's domestic industries, leading to job losses and reduced industrial output. Strategically, it creates a vulnerability in India's supply chain, as reliance on Chinese imports could be detrimental in times of geopolitical tensions or trade disputes.

Government's Response: The Indian government is aware of the challenges posed by the surge in Chinese steel imports and is considering measures to protect the domestic industry. These measures could include imposing tariffs or anti-dumping duties on Chinese steel to level the playing field for Indian producers. Additionally, the government may explore policies to encourage domestic production and reduce the reliance on imports.

Market Dynamics: The global steel market is currently experiencing fluctuations, with Chinese producers ramping up exports due to lower domestic demand and excess production capacity. This has led to a global oversupply of steel, driving down prices and making Chinese steel more attractive to importers worldwide, including India.

Trade Relations with China: The growing dominance of Chinese steel imports also reflects the broader trade relations between India and China. Despite ongoing geopolitical tensions, trade between the two countries continues to flourish, with China being one of India's largest trading partners. However, this trade relationship is marked by a significant imbalance, with India running a large trade deficit with China.

Future Outlook: The trend of rising Chinese steel imports is likely to continue unless significant interventions are made by the Indian government. The domestic steel industry will need to adapt to the changing market conditions by improving efficiency, cutting costs, and exploring new markets for exports. Additionally, India may need to reconsider its trade policies with China to address the growing trade deficit and protect its domestic industries.

Global Implications: The situation in India is not unique, as many other countries are also grappling with the impact of Chinese steel imports. The global steel industry is undergoing a transformation, with China's role as the dominant producer and exporter reshaping market dynamics. How countries like India respond to this challenge will have implications for the global steel trade and the future of the industry.

Conclusion: The surge in Chinese steel imports into India is a significant development that has far-reaching implications for the domestic steel industry and the broader economy. Addressing this issue will require a coordinated effort from the government, industry stakeholders, and policymakers to ensure that India's steel sector remains competitive and resilient in the face of growing foreign competition.