SEBI introduces new regulatory framework for depository receipts

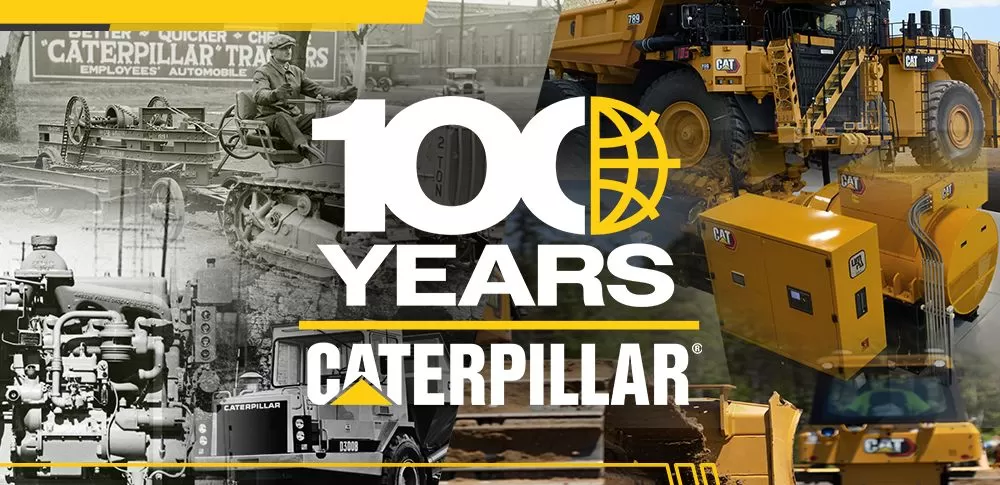

Caterpillar Celebrates 100 years

Caterpillar Inc., the world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives, celebrates its monumental 100th anniversary, Caterpillar team in India takes immense pride in its role in this legacy. With over 50 years of operations in India, Caterpillar has contributed significantly in building infrastructure and driving industrial progress in the country.For a century, Caterpillar’s customer-centric innovation and industry-leading transformation have helped shape the modern world..

Rustomjee Builds Model Labour Housing in Thane

In a pioneering move that redefines worker welfare in Indian real estate, Rustomjee Group has unveiled a state-of-the-art 35,000 sq. ft. labour housing facility at the construction site of Rustomjee Urbania in Thane. The project sets a new industry benchmark by integrating comfort, safety, sustainability, and dignity into housing for 500 construction workers. Spread across 84 well-ventilated rooms, each 10x10 feet and accommodating up to six individuals, the facility offers far more than basic shelter. It represents a deeper cultural shift in how the construction workforce is valued—creatin..

Young and Old Fuel India’s Housing Boom

India’s housing market is witnessing a surprising surge in interest from two distinct age groups—young professionals and senior citizens. A recent consumer sentiment survey of 1,950 prospective homebuyers reveals that both 18–24-year-olds and those aged 75 and above are showing strong intent to invest in real estate, highlighting a shift in how different generations are approaching property ownership. Young professionals, driven by rising incomes and a long-term view on wealth creation, recorded a Housing Sentiment Index (HSI) score of 164. Respondents from this group indicated they are..