Niti member: Better to get Chinese firms to invest in India

TRAI Evaluates Telecom Service in Nine Cities

In December 2024, the Telecom Regulatory Authority of India (TRAI) conducted Independent Drive Tests (IDT) across nine cities, highways, and railway routes, including Aligarh, Bhubaneswar, Jammu, Lucknow, Navi Mumbai, Raipur, Siliguri, Thiruvananthapuram, and the Vapi-Rewari Highway. The tests aimed to assess the quality of voice and data services provided by telecom operators such as Bharti Airtel, BSNL/MTNL, Reliance Jio, and Vodafone Idea using various technologies like 2G, 3G, 4G, and 5G. The drive tests evaluated Key Performance Indicators (KPIs) for both voice and data services, includi..

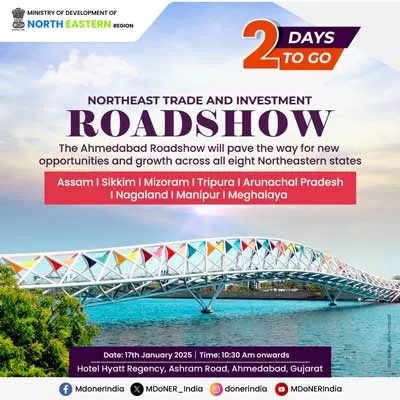

Kolkata to Host North East Trade & Investment Roadshow

Kolkata is set to host the North East Trade & Investment Roadshow on March 7, 2025, at Hotel JW Marriott, starting at 10:30 a.m. Organized by the Ministry of Development of North Eastern Region (MDoNER) in collaboration with FICCI and Invest India, the event aims to attract investors and promote economic opportunities in the North East. The roadshow will be graced by Dr. Sukanta Majumdar, Minister of State for MDoNER & Education, along with Shri Dharmvir Jha, Statistical Adviser, MDoNER, and senior representatives from all eight North Eastern states. The event will feature presentations on ke..

India’s Rooftop Solar Installations Surge by 86% in 2024

India added 3.2 GW of rooftop solar capacity in 2024, marking an 86% increase from the previous year, according to Mercom India Research’s latest Q4 & Annual 2024 India Rooftop Solar Market Report. The surge was largely fueled by the PM Surya Ghar: Muft Bijli Yojana, with the residential sector accounting for 74% of the total installations. In the wind power sector, NLC India and Adyant Enersol (Datta Infra) secured bids in SJVN’s auction for 600 MW of inter-state transmission system-connected wind projects. NLC India won 200 MW at a tariff of Rs 3.74/kWh, while Adyant Enersol secured 112..