L&T to sell 8 roads, transmission project to Edelweiss

Dealing with Delays

Delays have beleaguered many a construction project in India, hampering the country from building to its ability and potential, and leading to additional costs incurred by the contractor. The reasons for delayIn India, delays mainly occur owing to obtaining statutory approvals, non-provisioning of right of way, utility diversion and approval of drawings and design. Delays are broadly classified based on responsibility and effect. Excusable delays arise from factors beyond the contractor’s control, such as force majeure events or employer-induced delays. These delays generally entitle th..

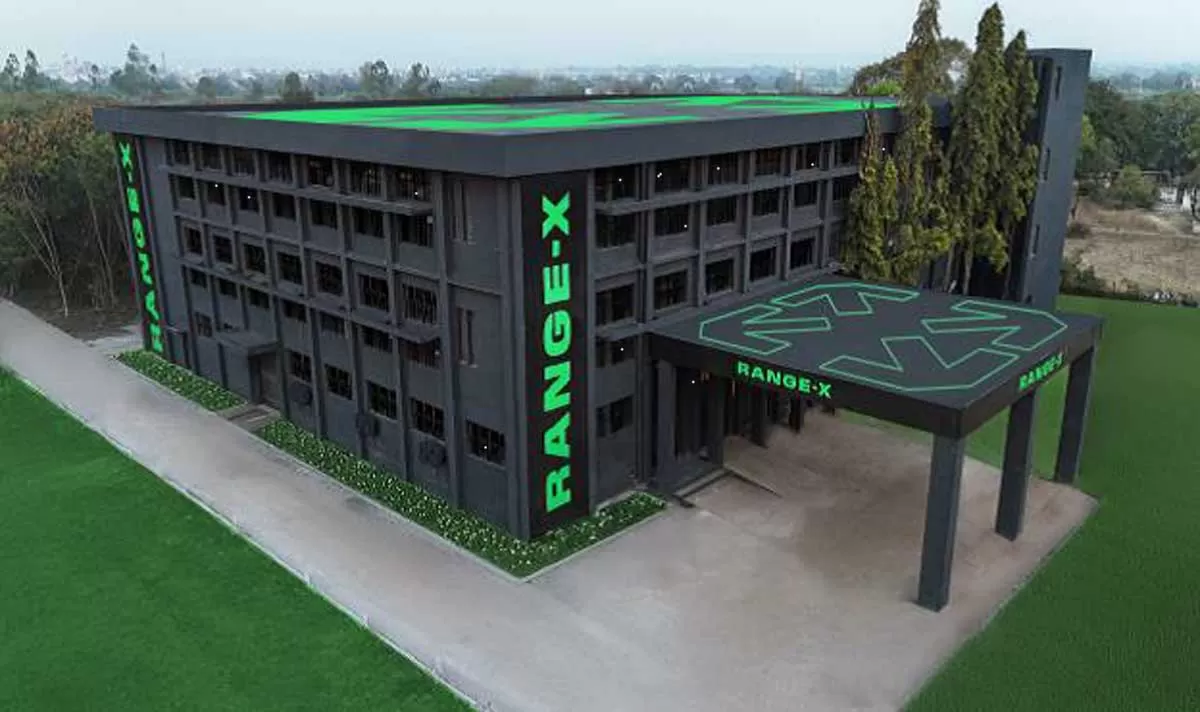

Kinetic Group Launches Range-X Battery Plant in Ahmednagar

Kinetic Group has inaugurated its advanced EV battery manufacturing facility in Ahmednagar under the Range-X brand. With a Rs 50 crore investment, the plant has a production capacity of 60,000 battery packs annually for two- and three-wheeler EVs.The facility will manufacture Lithium Iron Phosphate (LFP) and Nickel Manganese Cobalt (NMC) batteries, offering high energy density and smart battery management systems. Equipped with automated production lines and IoT-enabled quality checks, it complies with AIS 156 and AIS 004 standards.""Range-X is a result of pioneering work in batteries and a si..

The DBT scheme cut EVs cost by 25-30 per cent for end buyers

Jammu, the winter capital of Jammu & Kashmir, has emerged as a key growth hub in the region, recording an all-time high of 21.1 million tourist visits in 2023, with foreign tourist arrivals witnessing a remarkable 2.5-fold increase. This surge in tourism has contributed to the state’s robust economic performance, with the real gross state domestic product (GSDP) estimated at Rs 1.39 trillion for 2023-24. With capital expenditure accounting for 25.86 per cent of total receipts, the city’s innovative strides are gaining recognition, with Jammu Smart City’s e-mobility project winning th..