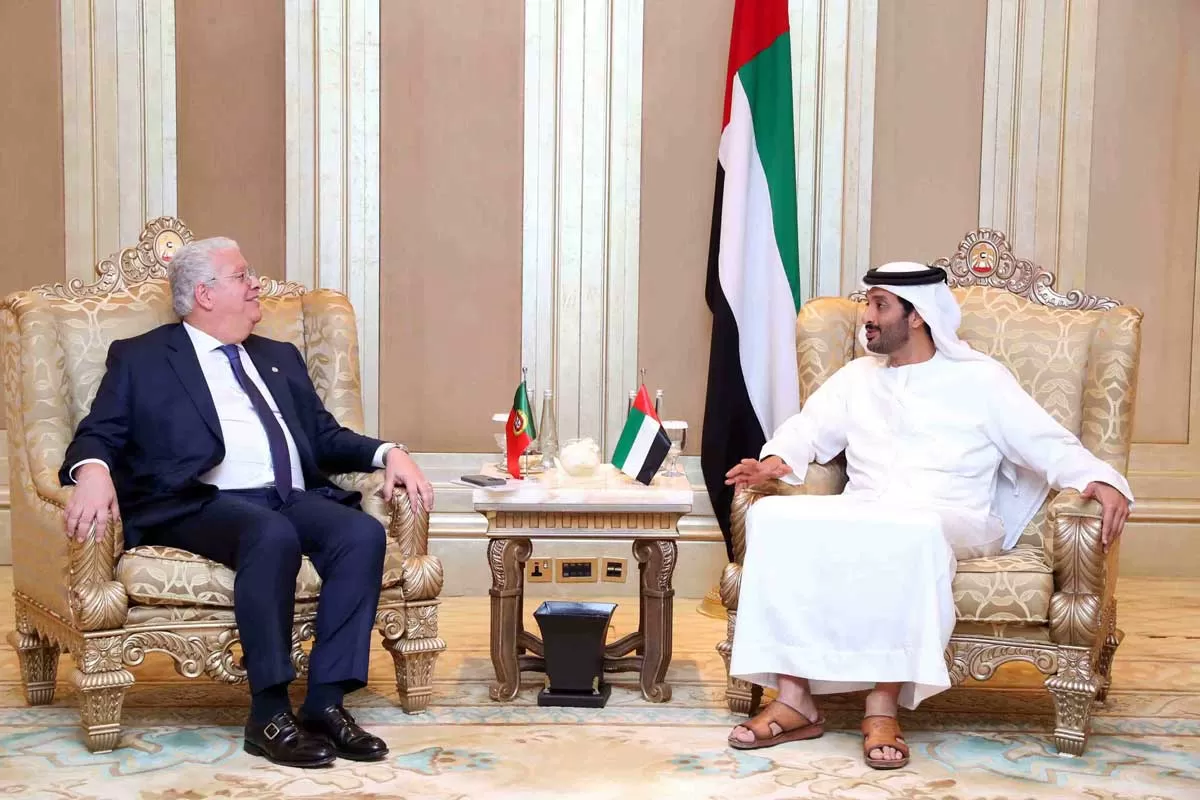

UAE, Portugal strengthen ties in aviation, tourism & clean energy

H.E. Abdulla bin Touq Al Marri, Minister of Economy and Chairman of the General Civil Aviation Authority (GCAA), held a bilateral meeting with his Portuguese counterpart H.E. Pedro Reis to explore the means to enhance economic partnership and investment exchanges between the two countries across various strategic sectors. The meeting was also attended by H.E. Fernando Figueirinhas, Ambassador of Portugal to the UAE, along with senior officials from both sides.The discussions took place on the sidelines of the fourth ICAO Global Implementation Support Symposium (GISS) 2025, organized by the Gen..

SG Holdings Acquires Morrison Express Shares to Expand Global Logistics

SG Holdings, a leading Japanese logistics company, has announced its acquisition of Morrison Express, a global freight forwarding and logistics service provider renowned for its expertise in semiconductor and high-tech logistics. This strategic acquisition will enhance the capabilities of the SG Holdings Group, significantly expanding on its Asian market presence and strengthening its position as a global leader in specialized logistics services.The acquisition brings together Morrison Express's strong competitiveness in the technology sector, particularly in semiconductors and high-tech produ..

Indraprastha Gas to set up CNG stations at Noida International Airport

Noida International Airport (NIA) has partnered with Indraprastha Gas Limited (IGL) to develop Compressed Natural Gas (CNG) infrastructure at the airport, reinforcing its commitment to sustainable and efficient transportation solutions. As part of the collaboration, IGL will establish two CNG stations—one in the west precinct and second one in the airside area—to cater to travellers, airport staff and partners.IGL will be responsible for the development of the City Gas Distribution (CGD) network at Noida International Airport, ensuring seamless connectivity to and from the CNG stations. Th..