Adani Group seeks additional lenders for $ 3.8B refinancing

LogiMAT India 2025 showcases 200+ Cutting-Edge Innovations

LogiMAT India 2025, showcased an impressive array of over 200 innovative products and cutting-edge technologies, set to transform India's thriving logistics sector. Groundbreaking solutions were unveiled at the event by industry pioneers such as Addverb, SICK India, Godrej Körber, Craftsman Automation, Godrej & Boyce, Tata Motors, Anscer Robotics, Armstrong Dematic, KION Group, Nilkamal Ltd., Ferag, Rubber King, Fronius, and many more. The show also spotlighted trailblazing innovations at the Startup Pavilion which was co-curated in partnership with Startup India. LogiMAT India 2025 provide..

ACREX India Opens with a Strong Industry Focus on Sustainability

ACREX India, the premier exhibition spotlighting the latest technological advancements and a comprehensive range of HVAC supply chain innovations, commenced at the Bangalore International Exhibition Centre (BIEC), Bengaluru. Organised by ISHRAE in collaboration with Informa Markets in India, the three-day event serves as a crucial platform for domestic and international manufacturers to engage with government officials, industry leaders, and key stakeholders. This year’s edition is expected to an impressive gathering of over 30,000 visitors and features a diverse showcase by more than 500 ex..

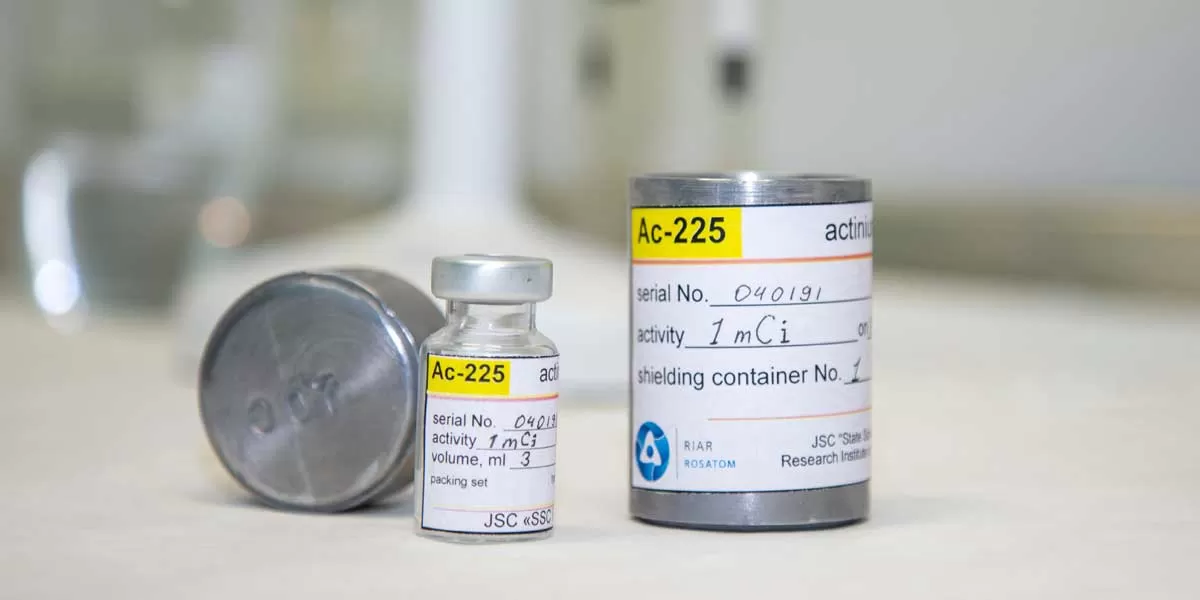

Rosatom Scientists Patent Tech for Separating Radium, Actinium, Thorium

The technology developed by nuclear scientists has enabled the production of actinium-225 that has a wide application in atomedics. Specialists from the Department of Radionuclide Sources and Preparations at the Research Institute of Nuclear Reactors, State Scientific Centre (RIAR JSC belongs to Rosatom’s Scientific division) have obtained a patent for the technology of producing an actinium-225-based radioactive preparation. Due to its unique properties, the isotope is deemed promising for use in the nuclear medicine and cancer therapy. The production technology ensures the product's high ..