Kobelco CE India Marks Milestone with 20,000th Excavator

Kobelco Construction Equipment India (KCEI), a subsidiary of Japan-based Kobelco Construction Machinery Co., has reached a significant production milestone by rolling out its 20,000th excavator at its manufacturing plant in Sri City, Andhra Pradesh. This facility serves both domestic and international markets, reinforcing India’s role as a key production center for Kobelco.Takemichi Hirakawa, Managing Director & CEO, Kobelco Construction Equipment India, said, ""Reaching the 20,000th excavator production milestone reflects our commitment to delivering high-quality construction equipment...

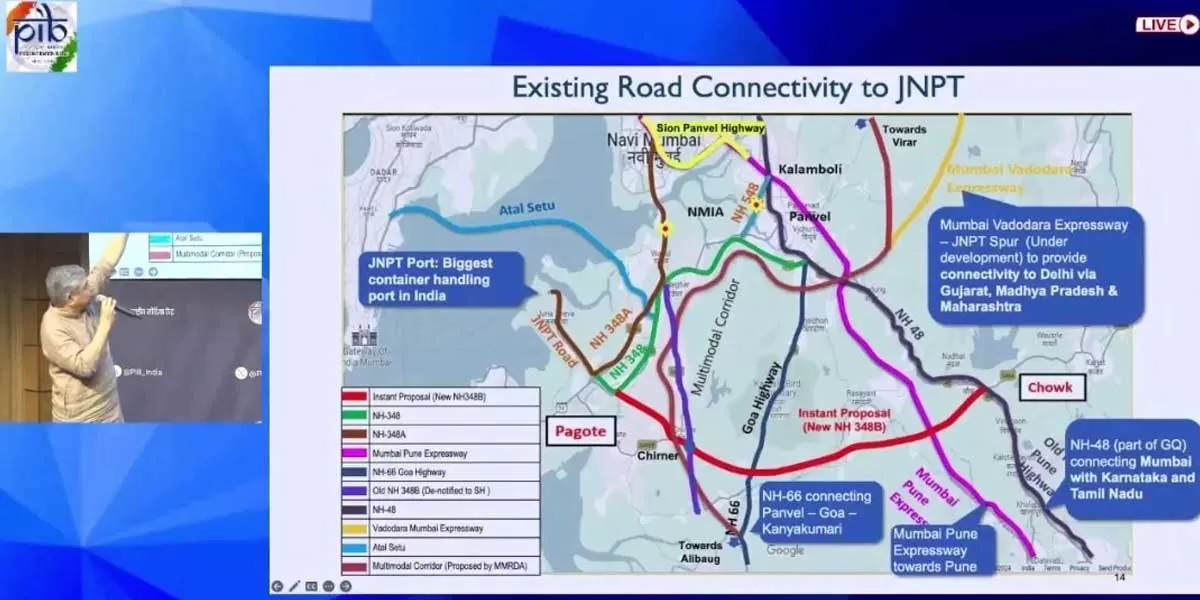

Cabinet Approves Highway from JNPA to Chowk in Maharashtra

The Cabinet Committee on Economic Affairs, chaired by Prime Minister Narendra Modi, has approved the construction of a 6-lane access-controlled Greenfield High-Speed National Highway from JNPA Port (Pagote) to Chowk in Maharashtra. The 29.219 km project will be developed on a Build, Operate, and Transfer (BOT) toll model at an estimated cost of Rs 45 billion. As part of the PM Gati Shakti National Master Plan, the project aims to enhance road connectivity to major ports, addressing increasing container traffic at JNPA and the upcoming Navi Mumbai International Airport. Currently, heavy co..

Effective Implementation of MGNREGA in the Last Decade

The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), enacted in 2005, aims to enhance livelihood security in rural areas by guaranteeing at least 100 days of wage employment per year to willing adult members of rural households performing unskilled manual labour. Over the years, the government has significantly increased budget allocations for the scheme. From Rs 113 billion in 2006-07, the allocation rose to Rs 330 billion in 2013-14 and reached a record Rs 860 billion in 2024-25. During the COVID-19 pandemic in 2020-21, the government spent Rs 1,110 billion under MGNREG..