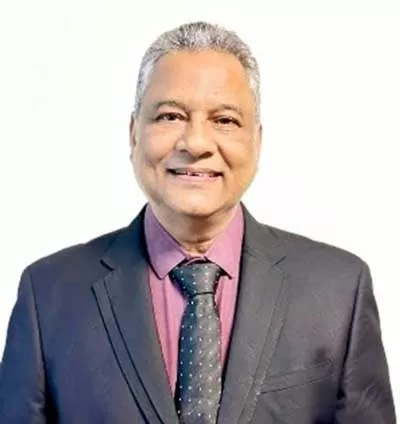

Ashok Singh Thakur named Chairman of INTACH

The AGM of Indian National Trust for Art and Cultural Heritage (INTACH) was held on 22 March 2025 at the Head Office in New Delhi. The Elections were held successfully for the post of Chairman and Governing Council members. After following due procedure the results were declared and Ashok Singh Thakur was elected as Chairman for a period of 3 years. INTACH is India’s premier heritage conservation organisation formally constituted on 27 January, 1984. It is a national registered Society under the Societies Registration Act (1860). Our mandate is to preserve and conserve the environment, to ..

Goa Shipyard Launches Second P1135.6 Frigate, Boosting Warship Building

Goa Shipyard (GSL), one of India’s premier defence shipyards, achieved yet another historic milestone with the successful launch of ‘Tavasya’, the second frigate of Project 1135.6 (Yard 1259) today, March 22, 2025. The launch marks a significant advancement in India’s self-reliance in warship construction, reinforcing the country’s vision of Atmanirbhar Bharat in defence manufacturing. The ship was ceremonially launched by Neeta Seth, in the esteemed presence of Sanjay Seth, Raksha Rajya Mantri, who graced the occasion as the Chief Guest. Addressing the gathering, Raksha Rajya Mant..

APEDA Flags off Goli Pop Soda, India's Iconic Drink for Global Markets

The Agricultural and Processed Food Products Export Development Authority (APEDA), under the Ministry of Commerce & Industry, Government of India, proudly announced the global resurgence of the traditional Indian Goli Soda, rebranded as Goli Pop Soda. This iconic beverage, once a household staple, is making a remarkable comeback on the global stage, driven by its innovative reinvention and strategic international expansion. The product has already made strong inroads in global markets, with successful trial shipments to the USA, UK, Europe, and Gulf countries. A strategic partnership with Fai..