NRI investments in Indian real estate may grow at 12%: Report

MAN Industries Monetises Navi Mumbai Land for TRs 7.20 Bn

In a strategic move to unlock value from its non-core assets, Merino Shelters Pvt Ltd (MSPL), a wholly owned subsidiary of MAN Industries (India), has entered into a development agreement with Paradise Green-Spaces LLP to monetize a prime land parcel in Nerul, Navi Mumbai, valued at approximately Rs 7.20 to 7.70 billion.The transaction, finalized on March 31, 2025, grants development rights for a approximately 6-acre plot located directly opposite the D.Y. Patil Stadium, one of Navi Mumbai’s most prominent landmarks. The location also benefits from its proximity to the upcoming Navi Mumbai I..

Maharashtra Ups Stamp Duty Rates for FY 2025–26

The Maharashtra government has announced an increase in Ready Reckoner Rates (RRR) for the financial year 2025-26, a move that is likely to influence property valuations, stamp duty, and registration charges across the state. The revised rates come into effect starting today, April 1, and mark the first revision since 2022–23.The State Registration and Stamps Department issued a notification late on March 31 confirming an average hike of 3.89 per cent across Maharashtra. These government-notified rates serve as the minimum property value benchmarks for tax calculations during transactions an..

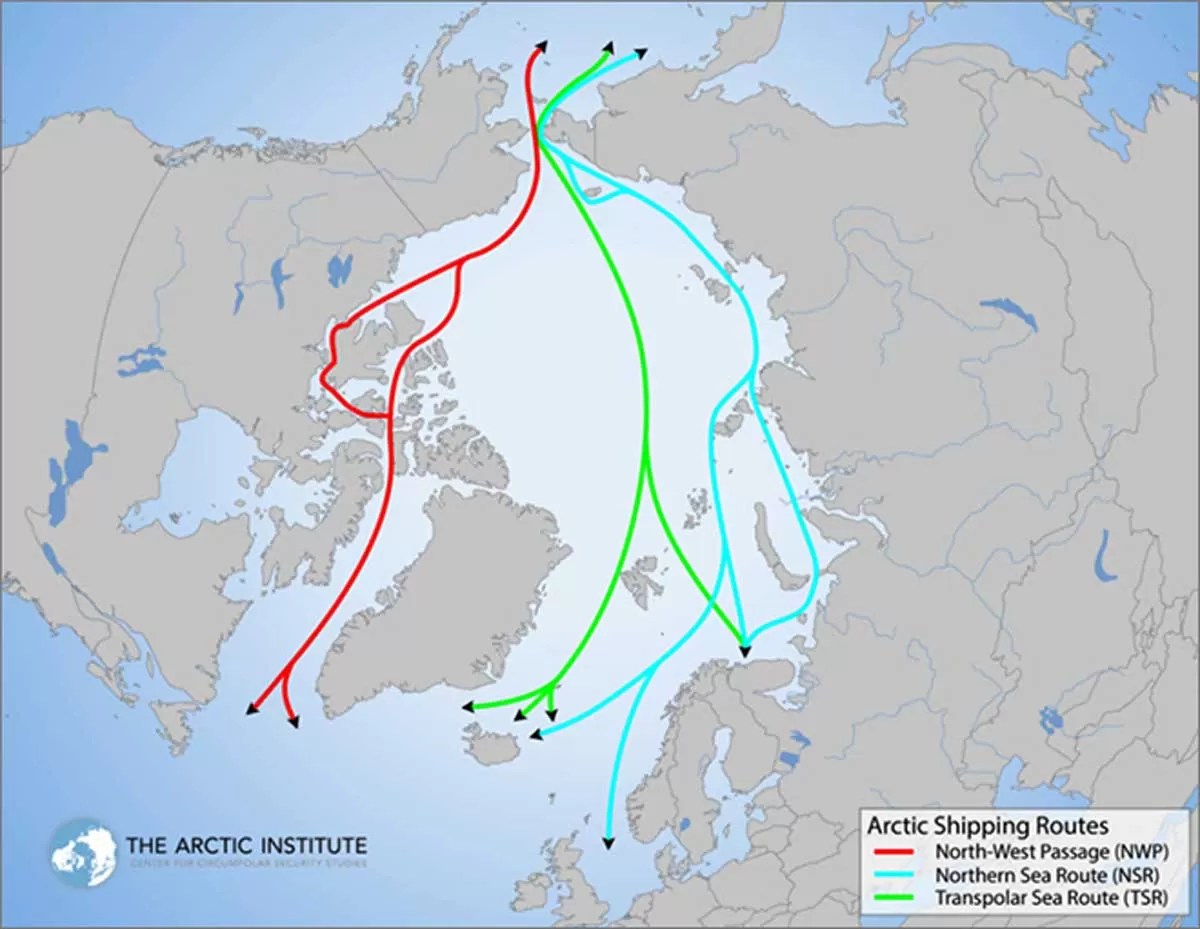

Rosatom Maps Long-Term Growth for Arctic Trade Route

At the VI International Arctic Forum: ""The Arctic – the Territory of Dialogue"", Russia’s state nuclear corporation Rosatom unveiled its long-term vision for the development of the Northern Sea Route (NSR) — a key transportation corridor linking Europe and Asia through the Arctic.During a session on the “Long-Term Development Model for the NSR,” Alexey Likhachev, Director General of Rosatom, emphasized the importance of forward-looking planning to handle rising cargo demands. He highlighted that the NSR saw a record 38 million tons of cargo in 2024, and projections suggest future tr..