Developers prioritise acquiring land in Mumbai and Delhi-NCR

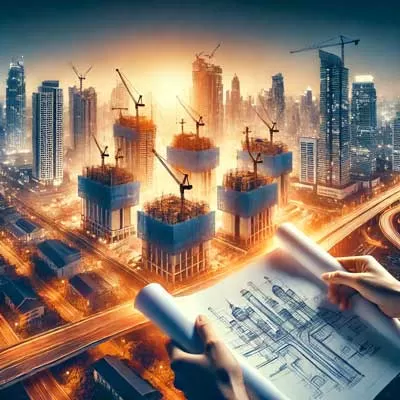

Roadmap for Encouraging Investment in The Indian Infrastructure Sector

The Union Budget 2025-26, unveiled by the Hon’ble Finance Minister, embodies a clear and ambitious vision, recognizing the pivotal role of investment in the economy as a key driver for national advancement. In alignment with this vision, the government has escalated the capital expenditure allocation for the infrastructure sector to an impressive Rs 11.21 lakh crore, marking a significant increase from previous years.Reflecting on the past, the Economic Survey of the preceding year underscored the government's dominant investment in infrastructure, which substantially exceeds private sector ..

Budget 2025: Real Estate Gains with Tax Cuts, New Investment Fund

India's construction and real estate sectors are poised for a significant boost, thanks to a series of strategic policy reforms announced by the finance minister. Aimed at revitalising stalled housing projects and spurring urban development, these initiatives include the launch of a new investment fund and tax relief measures that promise to ease financial burdens and stimulate market activity. As the government rolls out these changes, we are set to witness a transformative impact on the housing landscape, with benefits extending to homebuyers, investors, and the broader economy. This simplif..

Karnataka Offers 10% Incentive to Boost R&D Manufacturing

The Karnataka government will provide an additional 10% incentive to companies transitioning their research and development (R&D) operations into local manufacturing. This initiative, part of the state’s 2025-2030 industrial policy, aims to boost domestic production, said MB Patil, Minister for Large and Medium Industries. With over 400 Fortune 500 companies having R&D centers in Bengaluru but only 10% manufacturing locally, the revised policy offers flexible incentives, including production-linked and capital-based benefits. Employment-based incentives will also favor firms hiring women. ..