Sriram of IndusInd Bank: CE finance industry is a competitive marketplace

Read full article

CW Gold Benefits

- Weekly Industry Updates

- Industry Feature Stories

- Premium Newsletter Access

- Building Material Prices (weekly) + trends/analysis

- Best Stories from our sister publications - Indian Cement Review, Equipment India, Infrastructure Today

- Sector focused Research Reports

- Sector Wise Updates (infrastructure, cement, equipment & construction) + trend analysis

- Exclusive text & video interviews

- Digital Delivery

- Financial Data for publically listed companies + Analysis

- Preconceptual Projects in the pipeline PAN India

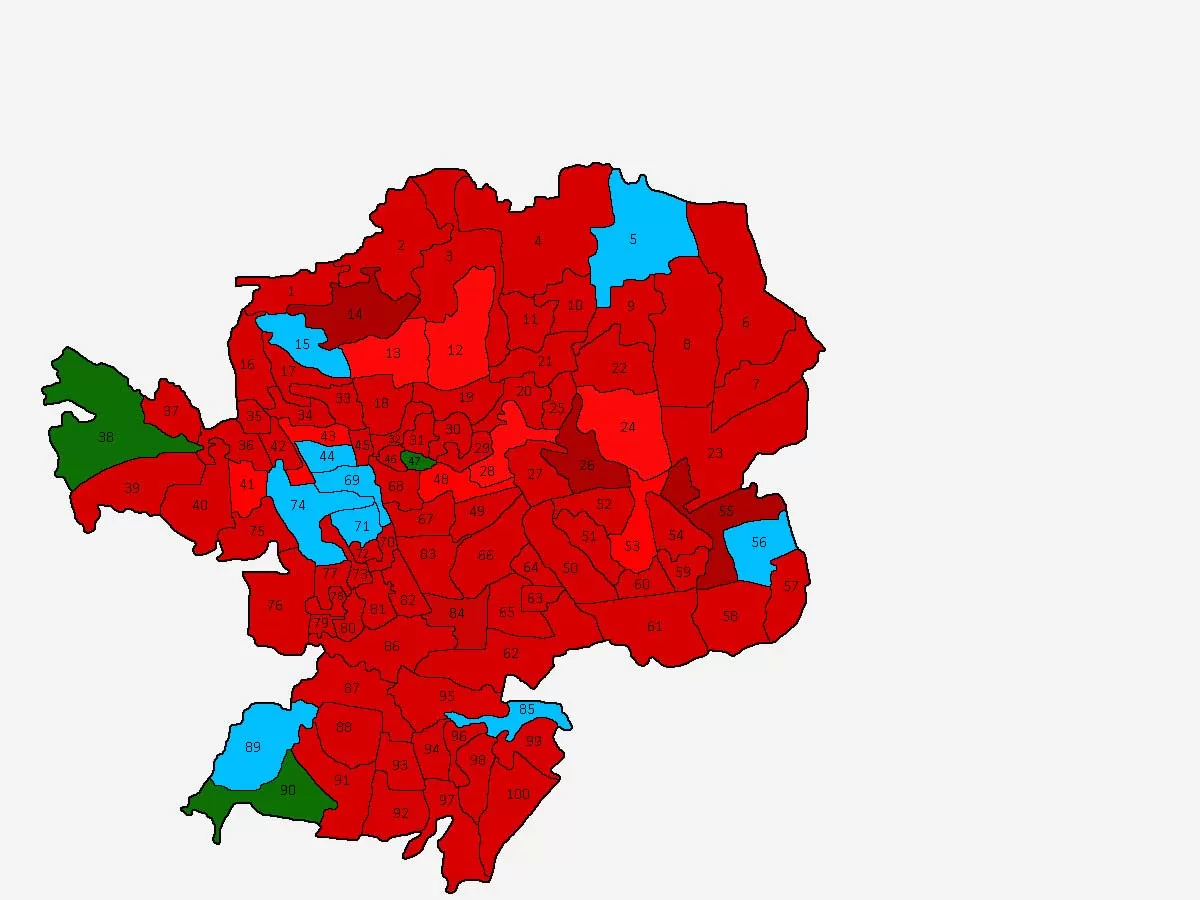

BBMP Tables Rs 199.3 Billion Budget for 2025-26, Focus on Infra

The Bruhat Bengaluru Mahanagara Palike (BBMP) has unveiled a Rs 199.3 billion budget for FY 2025-26, marking a 50% increase from the previous year. Developed under the "Brand Bengaluru" initiative, the budget prioritises large-scale infrastructure projects, including tunnel roads, elevated corridors, double-decker flyovers, and a sky deck project, spearheaded by Deputy Chief Minister D.K. Shivakumar. However, citizen groups have raised concerns over the lack of focus on basic infrastructure and public consultation.Financial overviewThe budget estimates Rs 111.49 billion from BBMP’s own reven..

Embassy Group Launches ‘Embark’ to Streamline GCC Expansion in India

Embassy Group, a leading real estate and business ecosystem developer, has introduced Embark, a fully integrated platform designed to simplify and accelerate the establishment of Global Capability Centres (GCCs) in India. The platform offers end-to-end solutions, enabling global enterprises to design, execute, and scale their India-based GCCs seamlessly. India is home to over 1,700 GCCs, with more than 400 new entrants in the last five years. The country’s robust STEM talent pool, tech and R&D ecosystem, cost advantages, and stable macroeconomic environment make it an attractive..

Coimbatore Corporation Conducts Survey for Metro Rail Road Expansion

The Coimbatore Corporation has launched a survey to facilitate road expansion along Sathyamangalam Road (NH-948) as part of the Coimbatore Metro Rail project. In the initial phase, the survey covers a 1.2 km stretch from Textool Bridge to Old Ganapathy Road, mapping land and underground utilities, including drinking water pipelines, underground drainage (UGD) pipes, gas pipelines, network cables, and electricity lines. A Corporation official stated that an earlier 20-meter survey was conducted for the National Highways Department’s road expansion plan, but with the Metro Rail proje..