Office Fit-Out Costs Rise in India amid Demand for Premium Workspaces

Office fit-out costs in India continued to rise in 2024, with Mumbai leading at US$73 per sq. ft., followed by Delhi at US$ 69 per sq. ft., according to Cushman & Wakefield’s latest Fit-Out Cost Guide. Bengaluru follows at US$67 per sq. ft., while Ahmedabad, Chennai, Hyderabad, Kolkata, and Pune stand at US$ 65 per sq. ft.Despite a three per cent year-on-year increase, India remains one of the most cost-effective office fit-out destinations in the Asia Pacific (APAC) region. The report notes a shift towards premium, tech-enabled, and sustainable workspaces as companies invest more per sq..

TKIL Industries’ Hyderabad Plant Earns Five-Star Safety Grading

TKIL Industries has achieved a Five-Star grading in the British Safety Council's Occupational Health and Safety Audit for its Hyderabad manufacturing plant. This follows a similar recognition for its Pimpri facility, reinforcing TKIL’s commitment to safety, risk management, and operational excellence.The Hyderabad plant, operational since 1988, manufactures equipment for sugar, mining, cement, and power industries and employs 720 workers. The audit assessed leadership, risk management, and organisational safety culture, covering 50 key health and safety components.Mike Robinson, CEO, British..

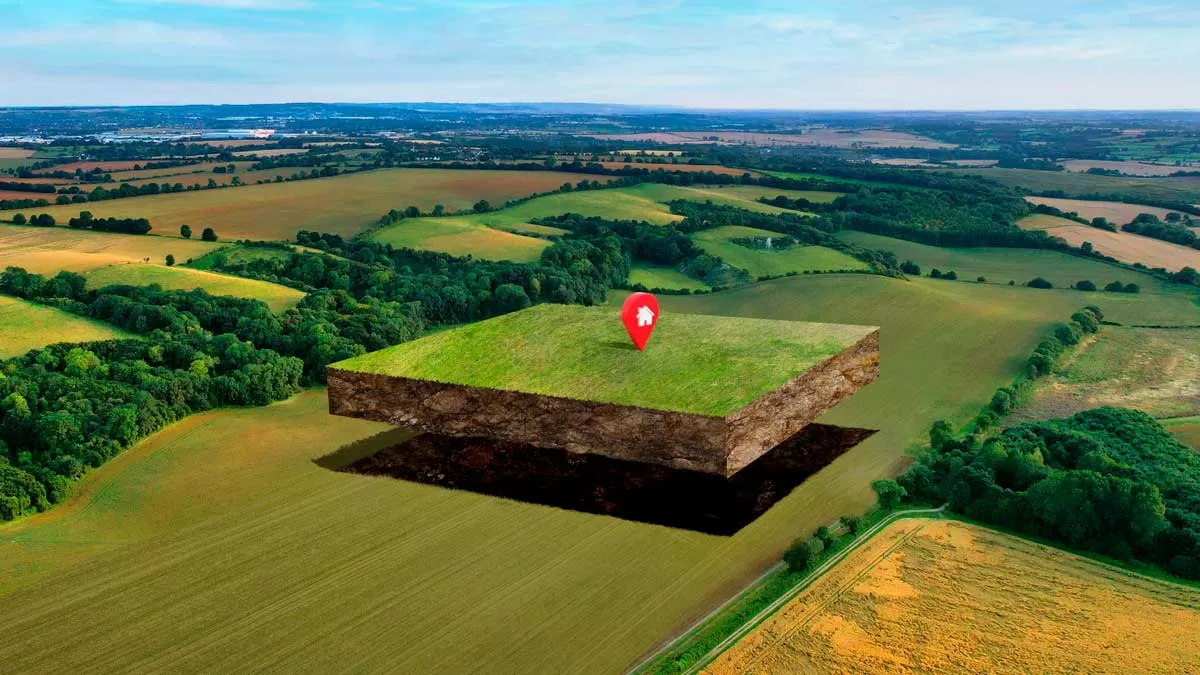

Bigdome Infra Acquires Prime Land in Kamba for Rs 1.3 bilion

Bigdome Infra has acquired 68.91 hectares of land in Kamba, Kalyan-Dombivli, for Rs 1.29 billion (bn), according to property registration data reviewed by Square Yards. The purchase was made through two transactions from multiple owners and was registered between February and March 2025. Kamba, an emerging locality in Maharashtra, offers connectivity to Kalyan, Ambernath, and Thane via National Highway 61 (NH 61) and nearby railway stations. The total stamp duty paid for the transaction was Rs 79.5 million. Registered on February 28, 2024, Bigdome Infra is a real estate-focused compa..