Delhi Micro-Markets Drive Up Housing Prices: Grihum Study

A new study by Grihum Housing Finance reveals that the rise of micro-markets across Delhi-NCR is fuelling real estate price appreciation, especially in the affordable housing segment. Key drivers include renewed post-pandemic interest, migration trends, and government schemes like PMAY.

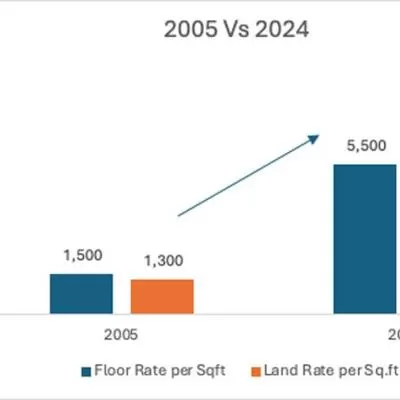

According to the study, over the past two decades, floor rates have risen 267 per cent, from Rs 1,500 per sq ft in 2005 to Rs 5,500 in 2024. In the same period, land rates surged 492 per cent, from Rs 1,300 to Rs 7,700 per sq ft. The sharp increase highlights strong capital appreciation in Delhi’s emerging locations.

Backed by banks and housing finance companies (HFCs), the region has expanded its housing supply to support the “Housing for All” mission. Emerging zones include Kakrola, Rajapuri, Mahavir Enclave, Chander Vihar, Palam, Amberhai Village, and Bamnoli, among others.

""At a time when India’s affordable housing sector is gaining structural momentum—driven by rurbanisation, income shifts, and PMAY—the ‘Grihum Guide to Affordable Housing: Delhi-NCR Edition’ arrives as a timely and field-rooted resource,"" said Manish Jaiswal, MD & CEO, Grihum. ""It uniquely evaluates the asset itself—not just the borrower—bringing sharper visibility on Net Credit Loss drivers.

The handbook includes affordability benchmarks, suggesting EMI brackets and recommended localities based on income levels. For instance:

- For income up to Rs 5 lakh p.a., EMI ~Rs 20,800: Areas like Rohini, Sangam Vihar, Deoli, Madangir.

- For income up to Rs 10 lakh p.a., EMI ~Rs 45,600: Locations include Kakrola, Qutub Enclave, Shyam Vihar.

The report also flags infrastructural challenges in Delhi-NCR—transport, healthcare, and sanitation—and proposes solutions through policy reforms and fast-track mechanisms.

With a footprint spanning Delhi and parts of Haryana, UP, and Rajasthan, the Grihum Guide serves as a critical tool for stakeholders in the affordable housing ecosystem.

Related Stories

Grihum Housing Finance Targets Rs 11,000 crore AUM Milestone by 2025

Grihum Housing Finance sets sights on Rs 11,000 crore AUM, driving housing aspirations

Page {{currentPage}} of {{pageCount}}

{{#products}}

{{copy}}